It is ideal for insurance companies to create policies that bear minimal risk and can generate stable returns. As an insurance broker you could work with both individuals and businesses.

Insurance covers various sectors including home healthcare auto general liability services life insurance among many others.

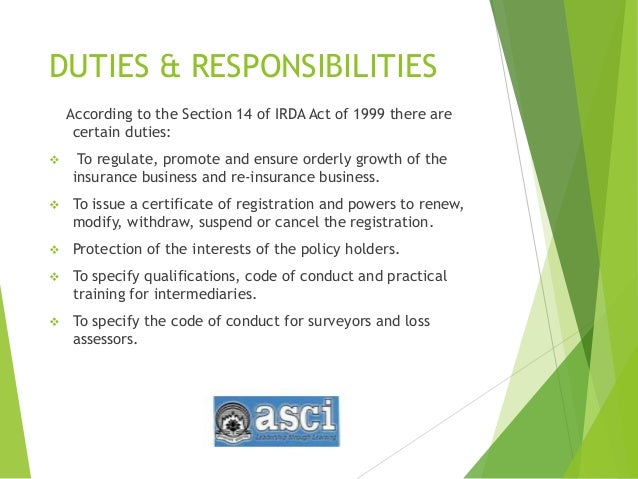

Roles and responsibilities of insurance company. The insurance provides safety and security against the loss on a particular event. An auto insurance agent also known as a car insurance agent is responsible for selling insurance policies aimed at insuring motor vehicles against varying risks including but not limited to thefts accidents damage and vandalism. In addition to responsibilities to their clients insurance companies also have the legal responsibility to.

Accessing customer accounts and policy schedules. Estimating risk and return from each proposal also in turn aids in assuring policyholders that their claims will be settled. Insurance companies are a special type of financial institution that deals in the business of managing risk.

Youll could also make recommendations to help clients lower their insurance costs and manage policies by assisting with changes renewals and cancellations. You might also represent companies selling various kinds of insurance such as auto life or health. Insurance Customer Service Representative Responsibilities.

What Does an Auto Insurance Agent Do. Insurance companies have a set of responsibilities to which they must abide. All these services require that you apply through the insurance.

Roles of Insurance Companies. This pooling of risk allows a group of people to share the burden of paying the costs of a particular event which reduces the likelihood of any one event financially devastating an individual. Auto Insurance Agent Job Description Duties and Responsibilities.

Due to the number of different risks a person will face during his. A key difference between individual life and non-life business Some traditional actuarial roles in life insurers Some non-traditional actuarial roles in life insurers. Chair IAA Asia Subcommittee.

Policyholders trust insurance companies to support them during a time of need and follow through with promises outlined in the policy. Darryl Wagner FSA MAAA. And why these roles are important.

Role of an Actuary in an Insurance Company. Yangon Myanmar 14 July 2014. An insurance underwriters role is to review the individual applications made for insurance policies and based upon perceived risk decide whether the policy shall be offered and at what cost.

In case of life insurance payment is made when death occurs or the term of insurance is expired. Life Insurance Company. Learning and understanding company insurance products.

The loss to the family at a premature death and payment in. This is largely a customer focused area of the business but requires a thorough and comprehensive knowledge of the entire industry. With regards to insurance actuarial practices involve analysing.

Insurance companies exist to pool individual risk. Answering calls and responding to customer complaints. A corporation periodically gives them money and in return they promise to pay for the losses the corporation incurs if some unfortunate event occurs causing damage to the well-being of.

What well cover. Insurance provides Security and Safety.